New Health & Wellness category is about to explode

Last Sunday I started my day in the bathroom staring at a needle. I took that needle and stuck it in my partner's arm. (It’s not what you think it is)

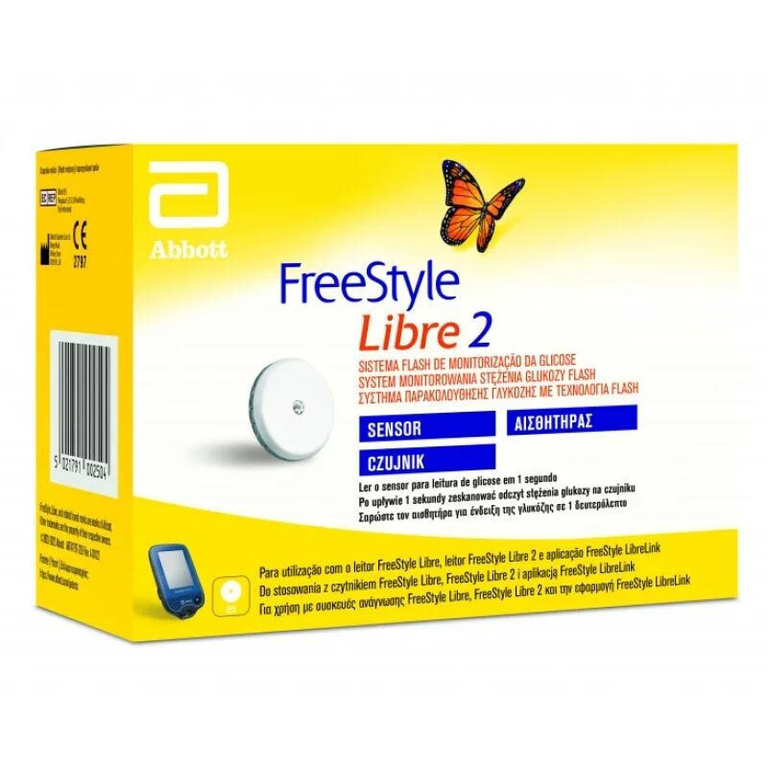

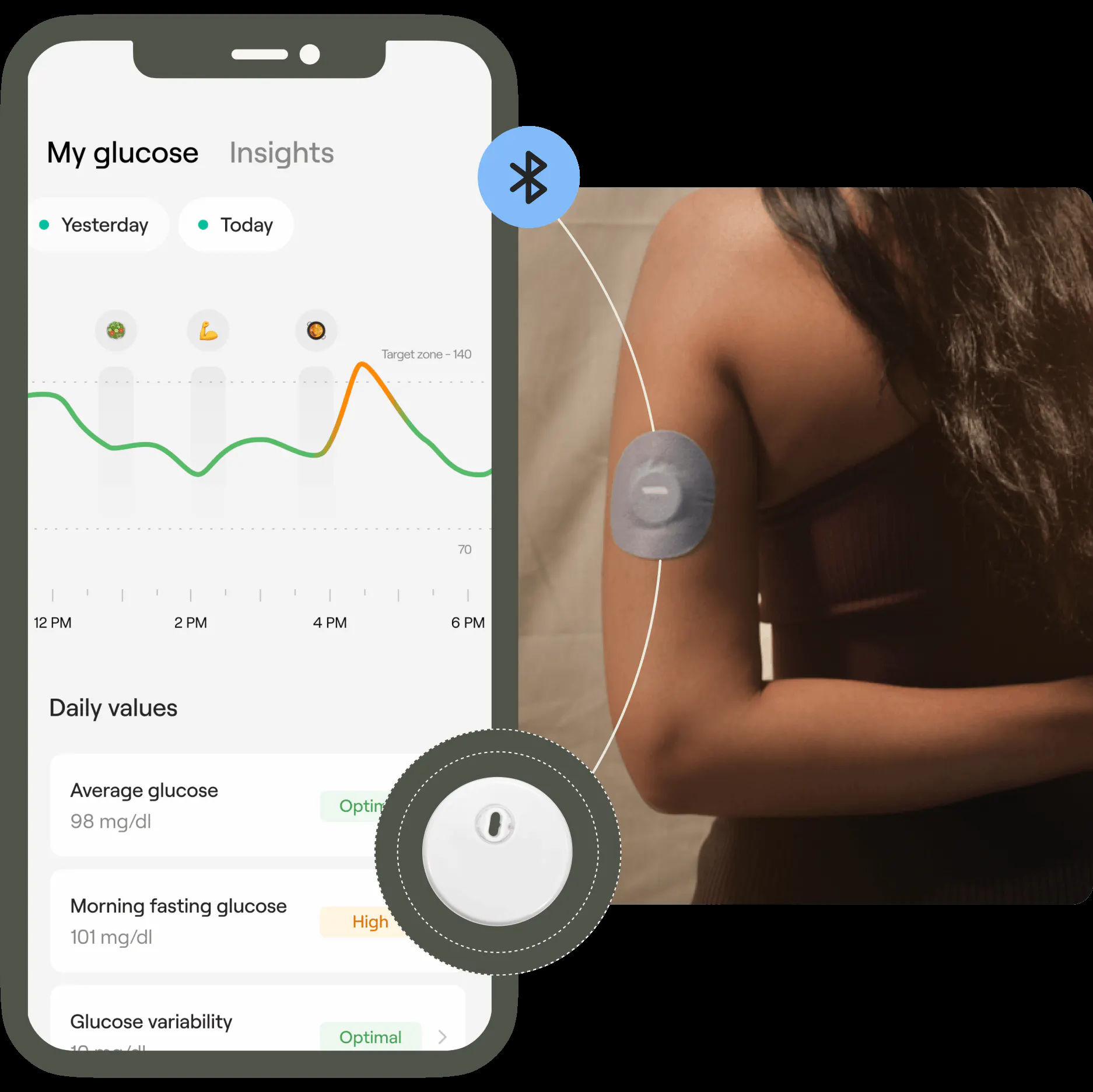

A few seconds before, she had done the same to me. After that we used our phones to scan and sync our needles to an app. To be accurate, we synced with a monitor on top of the needle. This device will monitor and display our glucose levels live for the next 14 days.

We are both experimenting with our diet and routines. We want to know what is good for us and what it is best to avoid. We are not alone doing so.

There are millions of people experimenting and trying out various things with the goal of longevity. This is a story as old as the sun. But now, there's a tectonic shift happening.

Even before Hippocrates, medicine was (and still is) kinda generic. One treatment for many. Now, affordable wearables, Big Data, and AI unlock the potential for personalised solutions.

A new technology in the wearables space is going to get us one step closer to that future.

Continuous Glucose Monitors (CGMs) are about to breakout.

Let's take a deep dive into the landscape.

Trends and market size

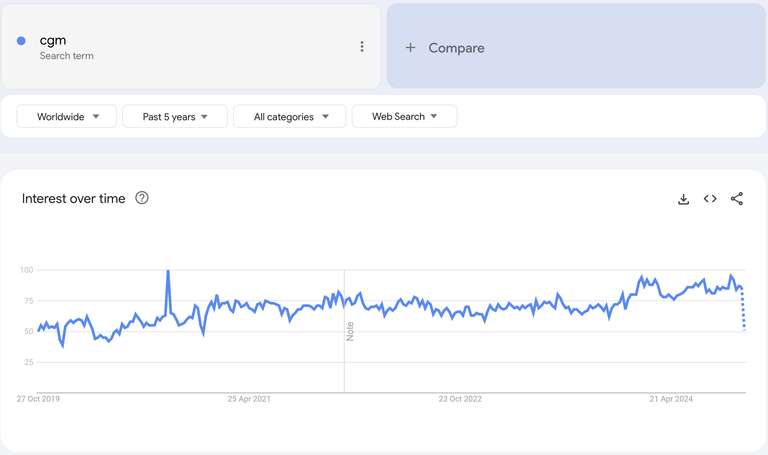

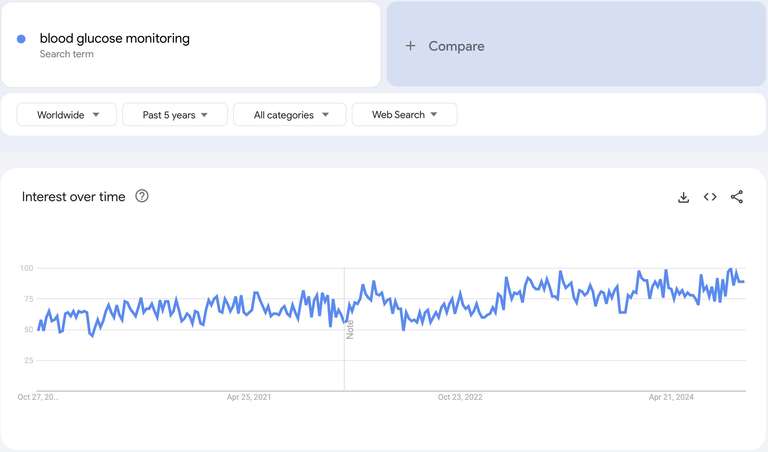

First of all let's check Google Trends to understand if it is a growing or a declining market.

Clearly, awareness is rising. But what is the the market size?

According to Mordor Intelligence the CGM market size in 2024 is estimated at $11.6 Billion with a compound annual growth rate of 12.89%. Meaning that they are forecasting a market size of around $21 Billion in 2029. These are huge numbers.

Keep in mind, these numbers include people with diabetes. However, our focus is on non-diabetics who want to optimize their health. It also has to be said that developments from the wellbeing area will have positive developments for the diabetes market.

From the same report: "As per the International Diabetes Federation (IDF), Africa is projected to witness a 134% surge in the diabetic population from 2021 to 2045, whereas North America and the Caribbean are expected to experience a 24% increase in the disease population. By 2045, China is likely to have the highest number of individuals affected by diabetes globally."

Big names pushing for the mainstream use of CGMs

A big trend of today’s marketing techniques is influencer marketing. Brands partner with influencers to push their products to their audience. The thing is that influencers in the health space are already advocating the use of CGMs, without brand deals. It's part of the knowledge revolution around better health.

Some big names advocating the use of CGMs:

That is a lot of exposure and things are just starting out. There are still only a few major players in the space and much room for new startups.

Brands that have brought glucose monitoring to the mainstream

Few companies in the software space are building for the mainstream. The are two leaders:

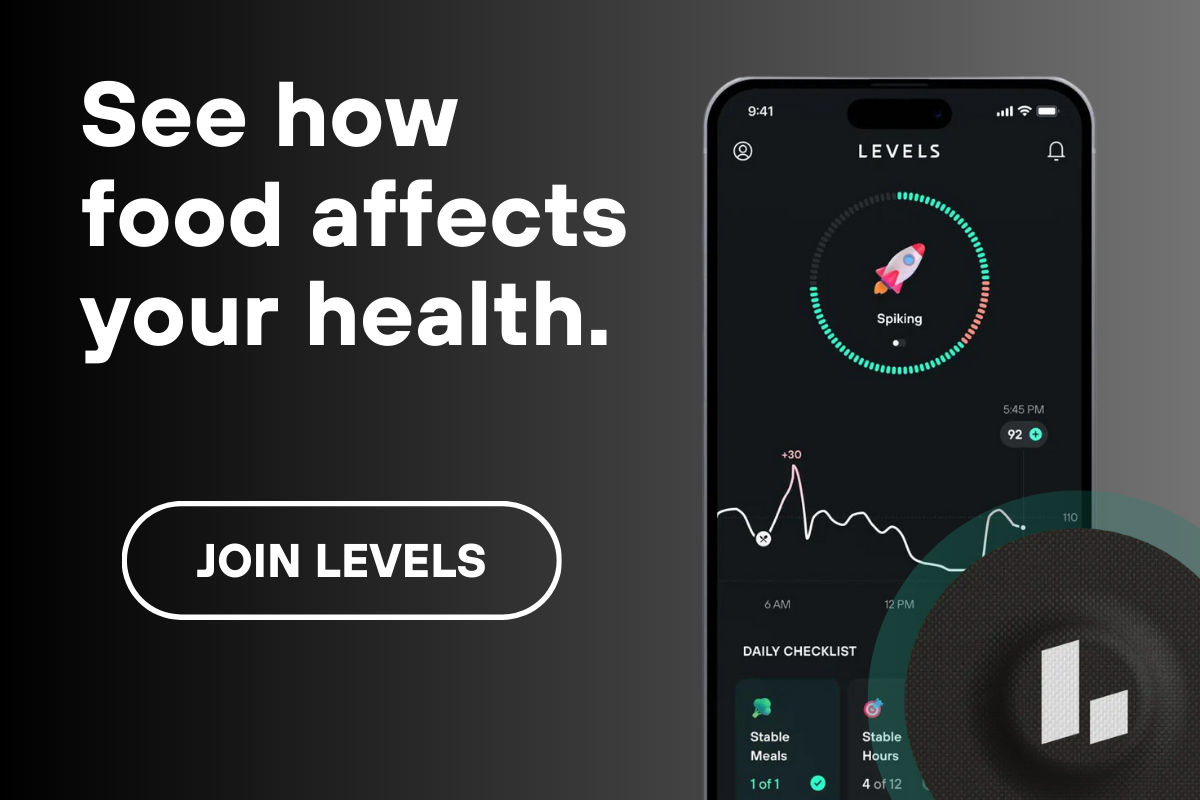

1. Levels

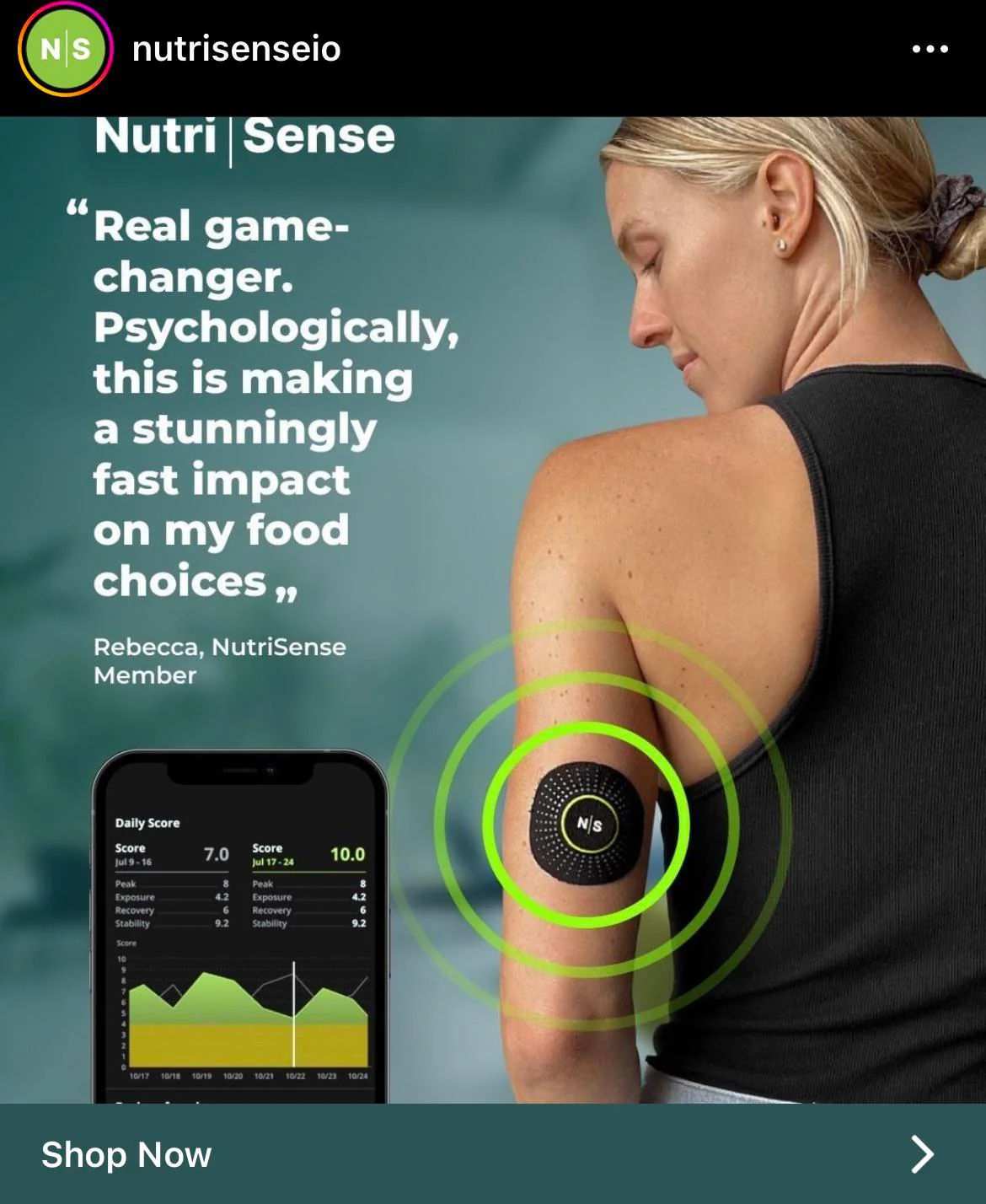

2. Nutrisense

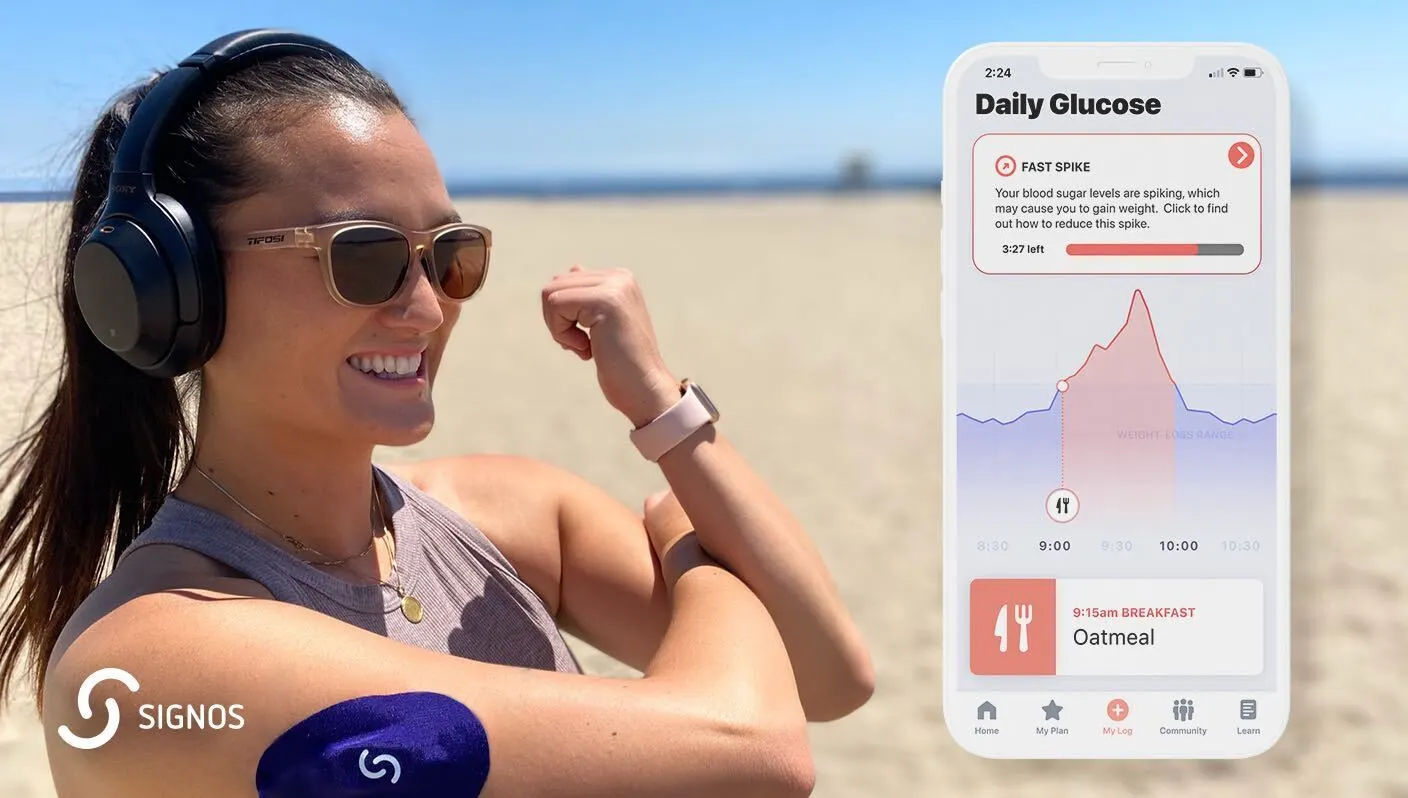

Other brands: Signos, Zoe, and Veri. And that’s about it.

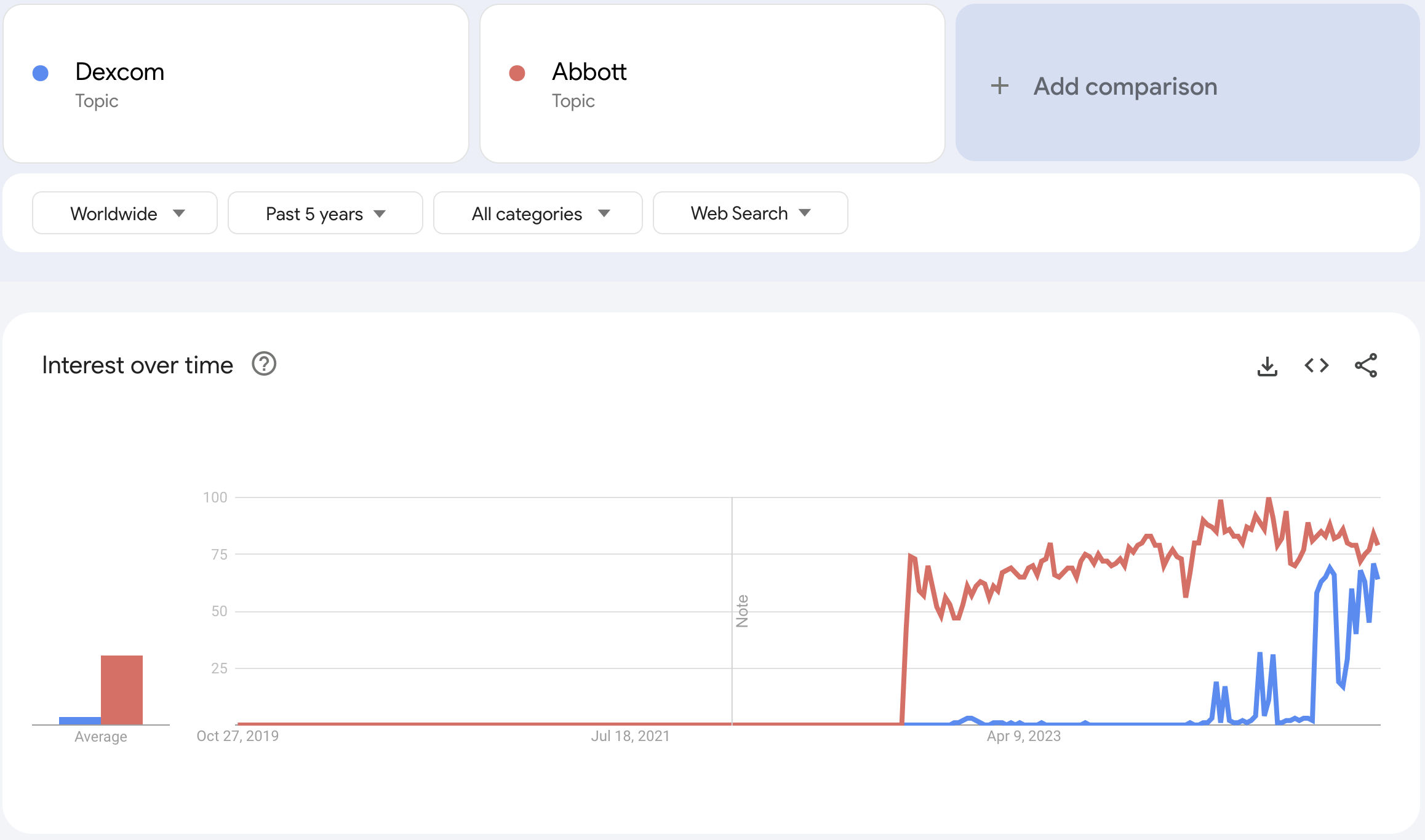

None of these companies produce CGMs. They have proprietary software that connect on top of the two market leaders in the CGM space: Abbott and Dexcom. And both companies are picking up fast.

The Dexcom G5, one of the first popular consumer CGMs, was released in 2015. Then, in 2017, Abbott released an affordable option with Freestyle Libre, unlocking a wider market. And then, we jump to today, where software solutions for the health-conscious people are starting to pop up.

Now, let's see what the big players in the space actually do:

Levels To date, Levels has raised more than $55 million to solve the metabolic health crisis. Existing investors include a16z, Trust Ventures, and Shrug Capital as well as notable founders and the Levels member community. Levels’ mission is to solve the metabolic health crisis by increasing accessibility to biomarkers, like real-time glucose, which are known to affect our health and risk of disease. Within the next five years, our goal is to shift the focus from healthcare to prevention, create transparency in the food industry, and provide individual empowerment through personal data.

In addition, Levels is conducting the largest ever study of its kind in collaboration with top researchers from around the world to increase understanding of glucose patterns among a wide variety of people (age, gender, and race) and advance the science about how lifestyle choices can affect these patterns. [source]

NutriSense is a metabolic health technology company with one simple mission: to help anyone discover and reach their health potential. Their unique approach of pairing data from continuous glucose monitoring technology with personalized 1-on-1 dietitian coaching is a key differentiator. The NutriSense platform allows members to personalize their nutrition, receive instant feedback to drive behavior change, and deliver an authentic human experience to guide members on their health journey. Raised $25 million [source]

Signos, a metabolic health platform that utilizes a uniqu

e AI-engine with a continuous glucose monitor (CGM) to offer real-time data and recommendations for healthy weight management, has announced a successful $20 million Series B funding round. The round was led by Cheyenne Ventures and GV (Google Ventures), with additional investments from Dexcom Ventures and Samsung. [source]

Zoe, a nutrition company based in London, is expanding its presence in the United States after raising $15 million in a Series B extension.

Here’s how it works: Zoe sends customers at-home testing materials to collect blood or feces to test blood fat, blood sugar, and gut microbiome health. Following those results, the company scores every food (on a scale from 0 to 100), so people can make better choices of what to eat. [source]

Veri provides people with an effortless and objective way of finding their optimal diet to improve the state of their metabolic health. The combination of Veri’s app with a wearable blood glucose tracker provides real-time feedback on food choices. The product gives its users deep insights by analyzing personalized blood sugar levels in the context of exercise as well as sleep habits. [source]

Veri raised a total of $3.5M and has been acquired by ŌURA.

For me, the acquisition of Veri by ŌURA is exciting. It signifies the start of the personalized-data-and-solutions era.

Much room to build

At the start of our little experiment, my partner and I set objectives. "Why are we doing this?"

For her, it is to know which foods to avoid and which pleasures she can enjoy guilt free.

For me, the same applies. But my ultimate objective is to remove as much friction as possible. I imagine a world where I have easy access to healthy foods that also are easy on my body. What if online food delivery apps adjusted to me and not the other way around? Whenever I would open these apps, they would re-arrange with the good options for me at the top and push the less healthy ones at the bottom. Or, how about a meal plan service that reads my data and sends me food that is good for me and that I like?

We now have a few options of hardware and a small, but growing, list of software options. Soon, for each individual, there is going to be a lot of data from a lot of sources. Each product or service is going to need and use these data to offer personalized solutions. I can already see the need for a tool (a dashboard?) that consolidates data from all the sources (CGM hardware, the rings, the watches, and all wearable solutions in general). It would create a unified version of data. Doctors, nutritionists, fitness coaches, meal planners could have access to this data and provide to us exactly what we want and need.

But before we go too far out to the future: Levels, Nutrisense, Signos are not even available in Europe. We only have Zoe and it is gated by a waiting list. Someone should do Levels or Nutrisense for Europe.

We are not there yet but we are not that far away. There is much room to build.